Creating a Long term financial plan to overcome your family finances is crucial for achieving financial stability and success. Whether you’re planning for personal goals or business growth, having a structured financial plan can guide your decisions and help you stay on track. This article will provide a comprehensive guide on how to create a long-term financial plan, including examples, templates, and key steps in the financial planning process.

What is a Financial Plan?

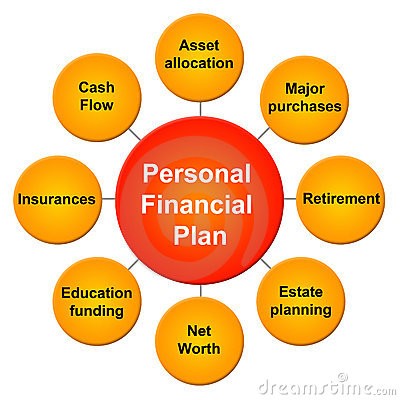

A financial plan is a strategic roadmap that outlines your financial goals and the steps needed to achieve them. It encompasses budgeting, saving, investing, and managing debt. A well-crafted financial plan ensures that you allocate resources efficiently and make informed financial decisions.

Personal Financial planning Example:

Let’s consider an example of personal financial planning:

- Current Situation: Monthly income of $5,000, monthly expenses of $3,500, savings of $10,000, and debt of $15,000.

- Goals: Save $50,000 for a home down payment in 5 years, pay off debt in 2 years.

- Strategy: Save $500 monthly, invest in a diversified portfolio, and allocate extra funds to debt repayment.

Benefits of a Long Term Financial Plan:

Having a long term financial plan offers numerous benefits, such as:

- Clarity and Direction: Helps you set clear financial goals and the path to achieve them.

- Risk Management: Identifies potential risks and provides strategies to mitigate them.

- Resource Allocation: Ensures efficient use of resources for maximum benefit.

- Financial Security: Helps build a strong financial foundation for future needs.

What is long term financial plan?

A long term financial plan is a comprehensive blueprint for your financial future. It outlines your financial goals, assesses your current financial situation, and creates a step-by-step strategy to achieve your objectives. Think of it as a roadmap that guides you towards financial security and independence.

8 Steps How to Create a Long Term Financial Plan:

Creating a long term financial plan is essential for achieving your financial goals. Whether you’re saving for retirement, buying a home, or starting a business, a well-crafted plan provides a roadmap to financial success. Let’s dive into the steps involved in creating a comprehensive financial plan.

1. Understanding Your Financial Situation:

The first step in creating a long term financial plan is to assess your current financial situation. This involves gathering information about your income, expenses, assets, and liabilities. By understanding your starting point, you can make informed decisions about your financial situation.

2. Setting Clear Financial Goals:

Once you have a clear picture of your financial situation, it’s time to define your financial goals. What do you want to achieve financially in the next five, ten, or twenty years? Whether it’s buying a house, saving for your children’s education, or retiring comfortably, having specific goals will help you stay focused and motivated.

3. Creating a Budget:

A budget is a crucial component of any financial plan. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your financial goals. By creating and sticking to a family budget, you can gain control over your finances and build an emergency fund.

4. Building an Emergency Fund:

An emergency fund is a safety net that can help you weather unexpected financial storms. Aim to save three to six months’ worth of living expenses in a high-yield savings account. This fund can provide peace of mind and prevent you from relying on credit cards in case of emergencies.

5. Managing Debt:

High levels of debt can hinder your financial progress. Create a plan to manage and reduce your debt by prioritizing high-interest debts and exploring debt consolidation options. By taking control of your debt, you can free up more money to save and invest.

6. Investing for the Future:

Investing is a key component of long term financial planning. Consider your risk tolerance and investment goals when choosing investment options. Diversifying your investments can help manage risk. Start investing early to take advantage of compound interest.

7. Protecting Your Assets:

Protecting your assets is essential for your financial security. This includes having adequate insurance coverage, such as health, life, disability, and homeowners or renters insurance. Review your insurance policies regularly to ensure they meet your needs.

8. Regularly Reviewing and Adjusting Your Plan:

Your financial situation and goals may change over time. It’s important to regularly review and adjust your financial plan to reflect these changes. By staying on top of your finances, you can make necessary adjustments and stay on track towards achieving your long-term goals.

Remember: A long term financial plan is a living document that should be revisited and updated regularly.

How to Make a Financial Plan for a Business:

Creating a financial plan for a business involves:

- Assessing Financial Health: Review the business’s financial statements, including income statements, balance sheets, and cash flow statements.

- Setting Business Goals: Define revenue targets, expansion plans, and other financial objectives.

- Developing Strategies: Create strategies for revenue growth, cost management, and capital investment.

- Using a Template: Utilize a business financial plan template to organize financial projections, budgets, and action plans.

Conclusion:

Creating a long term financial plan is essential for achieving financial stability and success. By following a structured financial planning process, you can set clear financial goals and develop effective strategies to achieve them. Whether you are crafting a personal financial plan or financial plan for a business, using examples can simplify the process. Regularly monitoring and adjusting your plan ensures you stay on track and adapt to changing circumstances. Start planning today to secure your financial future

FAQS:

1. What is the financial planning process?

The financial planning process is a systematic approach to managing your finances. It involves assessing your current financial situation, setting goals, creating a plan to achieve those goals, implementing the plan, and regularly monitoring and adjusting it.

2. Why is financial planning important?

Financial planning helps you make informed decisions about your money, reduce financial stress, and increase your chances of achieving your long-term goals.

3. What are the steps involved in the financial planning process?

The typical steps include:

- Gathering financial information

- Setting financial goals

- Analyzing your financial situation

- Developing a financial plan

- Implementing the plan

- Monitoring and adjusting the plan

4. Do I need a financial planner to create a financial plan?

While you can create a basic financial plan on your own, a financial planner can provide expert guidance and help you develop a comprehensive plan tailored to your specific needs.

5. What is an example of a long term financial plan?

An example of a long term financial plan includes setting goals like saving for retirement, buying a home, and creating an investment portfolio to achieve these goals over several years.

6. How do you create a long term plan?

To create a long term financial plan, assess your current financial situation, set specific goals, develop a strategy to reach those goals, implement the plan, and regularly review and adjust it as needed.

7. How do I create a 12-month financial plan?

Creating a 12-month financial plan involves setting short term financial goals, outlining your income and expenses, creating a monthly budget, tracking your progress, and making adjustments as necessary to stay on track.

8. How do I begin the process of creating a long-term financial plan?

Begin the process of creating a long term financial plan by evaluating your current financial status, defining your financial goals, and then crafting a detailed plan to achieve these goals. Regularly monitor and adjust your plan to ensure it remains effective.

External Resources:

NerdWallet: How to Create a Financial Plan The Balance: How to Make a Financial Plan

Empowering parents to raise happy, confident kids. Get practical parenting tips and advice on our blog, Smart Parent Guides.