Are you a parent looking to help your child finance their college education while managing your family budget and finances? The Parent PLUS loan is a federal loan program designed to assist parents in covering the cost of undergraduate or graduate school. In this guide, we’ll delve into everything you need to know about the Parent PLUS loan, from the application process to repayment options, ensuring that you make informed decisions that align with your family finances.

Understanding the Parent PLUS Loan Application:

Navigating the world of student loans can be challenging, especially when considering the Parent PLUS Loan application. This comprehensive guide will provide you with all the essential information, from how to apply for the loan to understanding the Parent PLUS Loan interest rate and repayment options.

What is a Parent PLUS Loan?

The Parent PLUS Loan is a federal loan available to parents of dependent undergraduate students. It helps cover education expenses not covered by other financial aid. This loan is part of the Direct Loan Program and can be a vital resource for families.

How to Apply for Parent PLUS Loan:

To begin the Parent PLUS Loan application process, parents must first complete the FAFSA (Free Application for Federal Student Aid). After submitting the FAFSA, you can apply for the Parent PLUS Loan directly through the U.S. Department of Education’s website. Here’s a step-by-step guide on how to apply for Parent PLUS Loan:

- Complete the FAFSA for your child.

- Log in to the Federal Student Aid website using your FSA ID.

- Select “Apply for a Direct PLUS Loan.”

- Fill out the application with your details.

- Review and submit your application.

Parent PLUS Loan Interest Rate:

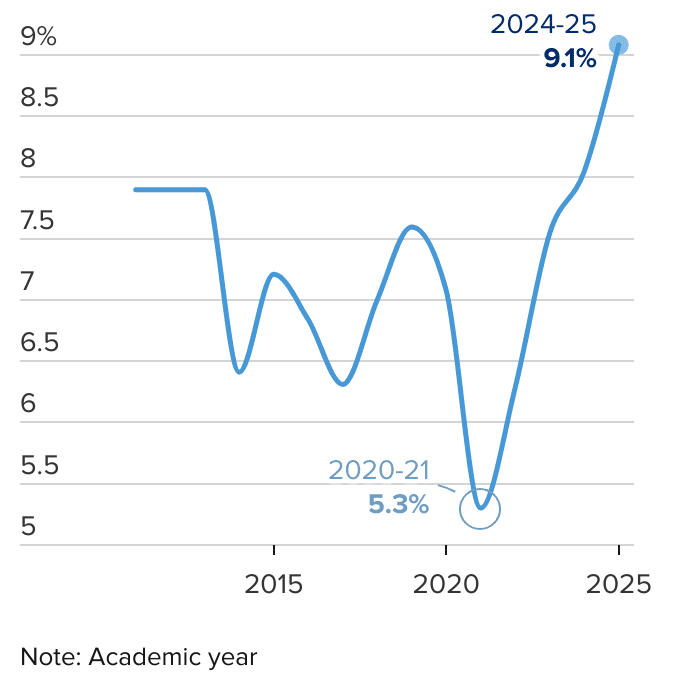

One of the key factors to consider before applying is the Parent PLUS Loan interest rate. For the 2024-2025 academic year, the interest rate is 7.54%. This rate is fixed and will not change over the life of the loan. Understanding this rate is crucial as it affects the total amount you will repay over time.

Federal Parent PLUS Loan vs. Direct Parent PLUS Loan:

The terms Federal Parent PLUS Loan and Direct Parent PLUS Loan are often used interchangeably. Both refer to the same federal loan program. However, it’s important to distinguish between them, as understanding the terminology can help you make informed decisions during the Parent PLUS Loan application process.

Parent PLUS Loan Calculator:

Before committing, use a Parent PLUS Loan calculator to estimate the total cost of borrowing, including interest. This tool can help you determine how much you’ll need to repay each month and over the life of the loan.Here’s a Parent PLUS Loan calculator you can use:

Name: Federal Student Aid Parent PLUS Loan Calculator

Parent PLUS Loan Repayment Options:

Once your loan is approved, it’s essential to explore Parent PLUS Loan repayment options. Repayment typically begins 60 days after the loan is fully disbursed, but deferment options are available while your child is still in school. Here are the primary repayment plans:

- Standard Repayment Plan: Fixed monthly payments for 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase.

- Extended Repayment Plan: Payments can be extended up to 25 years.

Consider discussing these options with your family office or financial advisor to ensure they align with your overall investment strategy and family finances. This will help you make informed decisions that fit within your family’s broader financial goals.

Parent PLUS Loan Consolidation:

For parents managing multiple loans, Parent PLUS Loan consolidation can simplify repayment. By consolidating your loans, you can combine them into a single loan with one monthly payment. This can also make you eligible for additional repayment plans and loan forgiveness programs.

Are Parent PLUS Loans Eligible for PSLF?

Public Service Loan Forgiveness (PSLF) is a program that forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under a qualifying repayment plan. If you’re wondering, are Parent PLUS Loans eligible for PSLF? The answer is yes, but only if they are consolidated into a Direct Consolidation Loan.

Parent PLUS Loan Forgiveness:

Although Parent PLUS Loans forgiveness options are limited, parents may qualify for loan forgiveness through programs like PSLF or the Income-Contingent Repayment (ICR) plan after consolidation. It’s important to explore these options if you anticipate difficulty in repayment. In certain circumstances, Parent PLUS loans may be eligible for forgiveness or cancellation, such as:

- Public Service Loan Forgiveness (PSLF): If you make 10 years of qualifying payments on a Parent PLUS loan while working for a government or nonprofit organization, the remaining balance may be forgiven.

- Teacher Loan Forgiveness: If you teach for five consecutive years in a high-need school or subject area, you may be eligible for up to $17,500 in loan forgiveness.

Do Parent PLUS Loans Qualify for SAVE Plan?

If you’re exploring repayment assistance, you might ask, do Parent PLUS Loans qualify for SAVE Plan? While they aren’t eligible directly, consolidating into a Direct Consolidation Loan could make them eligible for certain income-driven repayment plans.

Refinance Parent PLUS Loan: Lower Your Interest Rate

If you have a good credit score, you might consider refinancing your Parent PLUS Loan. Refinancing can help you secure a lower interest rate, reducing the total cost of the loan. Several private lenders offer Parent PLUS Loan refinance options.

Best Parent PLUS Loans:

When selecting a Parent PLUS Loan, consider the interest rate, repayment terms, and the lender’s reputation. The best Parent PLUS Loans offer competitive rates, flexible repayment options, and excellent customer service. Research and compare lenders to find the best fit for your needs.

Conclusion:

Applying for a Parent PLUS Loan is a significant financial decision. By understanding the application process, interest rates, repayment options, and eligibility criteria, you can make informed choices that benefit your family. Use the tools and resources available to ensure you’re making the best decision for your child’s education.

FAQS:

Can the student pay the parent PLUS loan?

No, legally the parent who took out the Parent PLUS loan is responsible for repaying it. However, some families may arrange for the student to make payments, but this does not transfer legal responsibility.

Can you combine Parent PLUS loans with student loans?

Yes, you can combine Parent PLUS loans with other federal student loans through consolidation into a Direct Consolidation Loan. However, the Parent PLUS loan remains in the parent’s name, and the combined loan will be ineligible for some repayment plans available to students.

Does Parent PLUS loan qualify for SAVE Plan?

No, Parent PLUS loans do not directly qualify for the SAVE (Saving on a Valuable Education) Plan. However, if the loan is consolidated into a Direct Consolidation Loan, it may qualify for certain income-driven repayment plans like Income-Contingent Repayment (ICR).

How many Parent PLUS loans can you take out?

There is no specific limit to the number of Parent PLUS loans you can take out. However, the total amount is limited by the cost of attendance at the student’s school minus any other financial aid received.

What is the Parent PLUS loan?

A Parent PLUS loan is a federal loan that parents of dependent undergraduate students can use to help pay for college. It covers the cost of attendance minus any other financial aid the student receives.

Is a Parent PLUS loan worth it?

A Parent PLUS loan can be worth it for families needing additional funds for college costs. However, it’s important to consider the interest rate, repayment terms, and the financial impact on the parent’s finances before taking it out.

Who pays back a Parent PLUS loan?

The parent who took out the Parent PLUS loan is responsible for repaying it. The repayment begins once the loan is fully disbursed, though parents can request to defer payments while the student is in school.

What is the current Parent PLUS loan rate?

As of the 2023-2024 academic year, the interest rate for Parent PLUS loans is 8.05%. This rate is fixed for the life of the loan but may vary for new loans in subsequent years.

External Resources:

U.S. Department of Education – Federal Student Aid (studentaid.gov)

- URL: Federal Student Aid

Consumer Financial Protection Bureau (CFPB)

- URL: CFPB Student Loans

The Institute for College Access & Success (TICAS)

- URL: TICAS

National Association of Student Financial Aid Administrators (NASFAA)

- URL: NASFAA

Empowering parents to raise happy, confident kids. Get practical parenting tips and advice on our blog, Smart Parent Guides.