Planning for your family’s financial future starts with the right smart investment strategies for parents. Whether you’re saving for your child’s education, securing retirement funds, or building wealth, a smart investment plan is essential. Beginners can benefit from tools like a smart investment calculator to estimate returns and track financial goals. Additionally, using a smart investing app makes it easier to manage portfolios efficiently. But what are the most effective approaches?

This guide explores the best smart investment strategies and explains the 4 investment strategies parents can use to secure a stable and prosperous future. Let’s get started!

1. Creating a Smart Investment Strategies:

A smart investment is the foundation of successful investing. Here’s how to create one:

- Set Clear Goals – Decide whether you’re investing for retirement, a home, or wealth accumulation.

- Determine Risk Tolerance – Conservative investors may prefer bonds, while aggressive investors might choose stocks, ensuring they align with both financial goals and ways to save money in the long run.

- Diversify Your Portfolio – A mix of assets like stocks, bonds, and real estate reduces risk.

- Rebalance Periodically – Adjust your investments based on market performance to stay aligned with your goals.

2. Using a Smart Investment Calculator to Plan Returns:

A smart investment calculator helps estimate returns and assess investment performance. These calculators consider:

- Initial investment amount

- Expected rate of return

- Investment duration

- Monthly or yearly contributions

Popular tools like the Smart Asset Investment Calculator can guide your financial planning.

3. Best Smart Investment Strategies for Long-Term Growth:

The best smart investment strategies include:

- Dollar-Cost Averaging – Invest a fixed amount regularly to reduce market volatility risks.

- Dividend Investing – Focus on stocks that pay consistent dividends for passive income.

- Growth Investing – Target high-growth companies for substantial long-term returns.

These strategies can help both beginners and experienced investors maximize returns while managing risks.

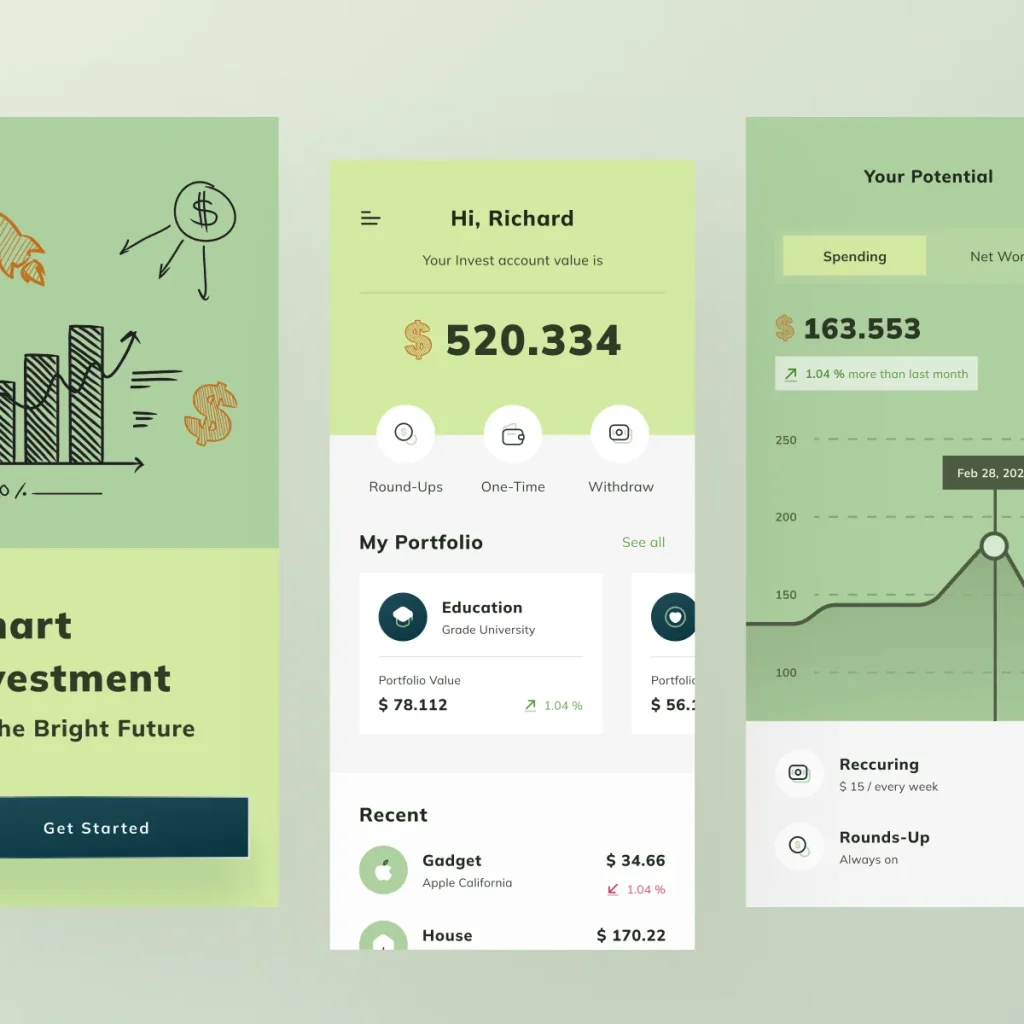

4. The Best Smart Investing Apps for Beginners:

Technology has simplified investing, and choosing the right smart investing app can enhance your strategy. Here are the best options:

- Robinhood – A user-friendly app with commission-free trading.

- Acorns – Ideal for beginners, Acorns rounds up purchases and invests spare change.

- M1 Finance – Offers automated investing with customizable portfolios.

- Wealthfront – Provides automated investment management with tax-efficient strategies.

Using a smart investing app can make investment tracking and portfolio management more convenient.

5. What Are the 4 Investment Strategies?

Understanding what are the 4 investment strategies can help you make better financial decisions. The key strategies include:

1. Value Investing:

Invest in undervalued stocks with strong fundamentals. Warren Buffett is a well-known advocate of this strategy.

2. Growth Investing:

Focus on companies expected to grow faster than the market. Tech stocks like Apple and Tesla are common choices.

3. Income Investing:

Choose investments that generate regular income, such as dividend stocks and bonds.

4. Index Investing:

Invest in index funds or ETFs that track a market index for a diversified, low-cost approach.

Each of these strategies caters to different risk levels and financial goals.

6. Risk Management in Smart Investment Strategies:

Managing risk is essential for long-term financial success. Consider these risk management tactics:

- Asset Allocation – Distribute investments across various asset classes.

- Stop-Loss Orders – Set predefined price points to limit losses.

- Portfolio Rebalancing – Adjust asset allocation to maintain risk tolerance.

- Emergency Fund – Keep cash reserves for unexpected financial needs.

By incorporating these methods, you can protect your investments from market downturns.

7. How to Start Investing as a Beginner?

If you’re new to investing, follow these steps:

- Educate Yourself – Read books, follow financial news, and take online courses.

- Open an Investment Account – Choose a brokerage or investing app that suits your needs.

- Start Small – Invest a small amount to gain experience before committing more funds.

- Stay Consistent – Regular investing leads to long-term growth.

These steps will help you build confidence and develop effective investment habits.

Conclusion:

Building a secure financial future starts with implementing the right smart investment strategies for parents. By creating a well-structured smart investment plan, you can ensure long-term financial stability for your family. Utilizing tools like a smart investment calculator helps track progress, while a smart investing app simplifies portfolio management. Exploring the best smart investment strategies allows you to make informed decisions and maximize returns. Understanding what are the 4 investment strategies further enhances your ability to grow wealth while managing risks. Start investing wisely today and take control of your family’s financial future!

FAQS:

What is the smartest way to invest?

The smartest way to invest is by diversifying your portfolio, focusing on long-term growth, and using a smart investment plan that aligns with your financial goals. Utilizing a smart investment calculator and a smart investing app can help track and optimize your investments effectively.

What is the best investment strategy?

The best investment strategy depends on your risk tolerance and goals, but smart investment strategies for beginners often include index funds, dollar-cost averaging, and asset diversification. These methods help reduce risk and ensure steady financial growth.

What is Warren Buffett’s investment strategy?

Warren Buffett follows a value investing approach, focusing on long-term investments in high-quality companies with strong fundamentals. His smart investment strategies emphasize patience, buying undervalued stocks, and reinvesting dividends for sustained growth.

What are the 4 main investments?

The four main types of investments are stocks, bonds, real estate, and cash equivalents. Understanding portfolio.

External Resources:

Empowering parents to raise happy, confident kids. Get practical parenting tips and advice on our blog, Smart Parent Guides.